-

Accelerating Image Convolution with CuPy

In this project, we’ll use CuPy to speed up image convolution, a fundamental operation in image processing used for tasks like blurring, sharpening, and edge detection. Convolution applies a small matrix (called a kernel) to an image by sliding it over each pixel and computing a weighted sum of neighboring values. This process is computationally…

-

Estimating π with a Monte Carlo Simulation Using CuPy

In this project, we’ll use CuPy, a GPU-accelerated computing library, to estimate the value of π through a Monte Carlo simulation. This approach leverages random sampling to approximate π by simulating points in a square and circle, making it a fun and practical demonstration of CuPy’s power for parallel numerical tasks. What is CuPy and…

-

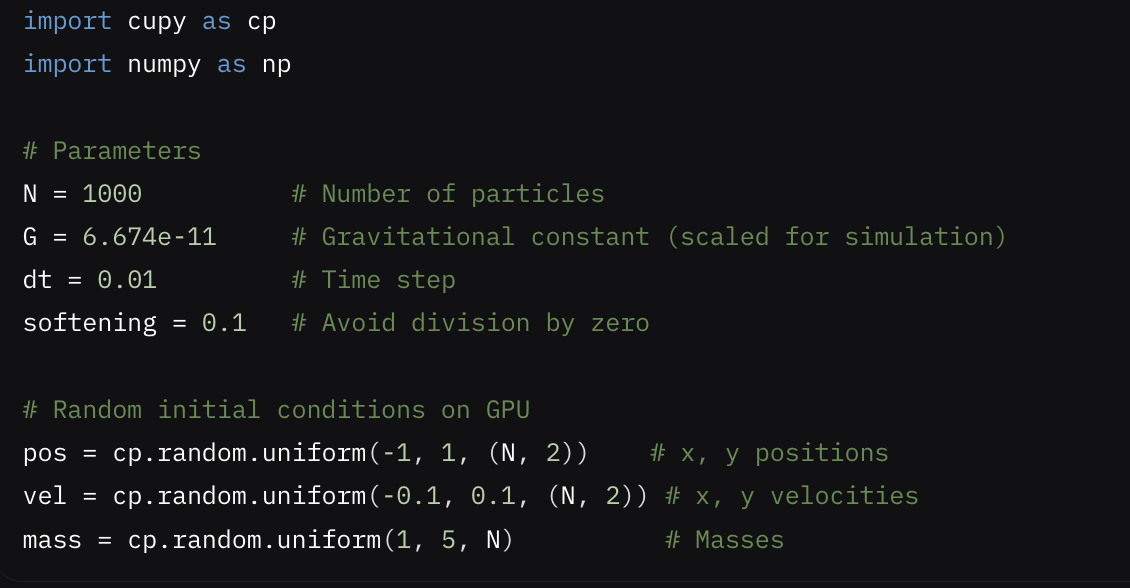

N-Body Simulation with CuPy: A GPU-Accelerated Approach

In this project, we’ll use CuPy to simulate an N-body gravitational system, where multiple particles interact under gravity. This is a classic physics problem that scales poorly with the number of particles on a CPU due to its (O(N^2)) complexity. CuPy’s GPU acceleration shines here, speeding up the pairwise force calculations. We’ll walk through the…

-

Building a 2D Heat Equation Simulation with CuPy: A Step-by-Step Guide

In this blog post, we’ll use CuPy, a NumPy-compatible library for GPU-accelerated computing, to build a practical project: simulating the 2D heat equation. This isn’t about basic setup or simple examples—instead, we’ll create a numerical simulation from scratch, compare CPU and GPU performance, and visualize the results. By the end, you’ll see how CuPy can…

-

Dash: Python Framework for Building Interactive Web Applications for Data Visualization

1. Introduction Dash is an open-source Python framework for building interactive, data-driven web applications. Developed by Plotly, Dash is specifically designed for creating dashboards and analytical web apps that integrate seamlessly with Python data science workflows. It allows developers to build complex applications with minimal code, leveraging Python for both backend logic and frontend interactivity.…

-

Streamlit: Python Framework for Building Interactive Web Applications for Data Science

1. Introduction Streamlit is an open-source Python framework designed for building interactive and data-driven web applications. It allows developers to create web apps for machine learning, data visualization, and analytics with minimal effort. Streamlit is widely used in data science and machine learning workflows for creating dashboards, prototypes, and tools to share insights and models.…

-

Flask: Lightweight Python Web Framework for Building Scalable Web Applications

1. Introduction Flask is a lightweight and flexible Python web framework designed for building web applications and APIs. Unlike Django, Flask follows a “micro-framework” philosophy, providing only the essential tools for web development while allowing developers to choose additional components as needed. Flask is widely used for building scalable and modular applications, ranging from simple…

-

Django: High-Level Python Web Framework for Scalable Web Applications

1. Introduction Django is a high-level Python web framework that enables rapid development of secure and scalable web applications. It follows the “batteries-included” philosophy, providing built-in tools for handling common web development tasks such as database management, user authentication, and URL routing. Django is widely used in industries ranging from e-commerce to social media, powering…

-

CuPy: GPU-Accelerated Array Computation Library for Python

1. Introduction CuPy is an open-source Python library designed for GPU-accelerated array computation. It provides a NumPy-compatible interface, enabling users to perform high-performance numerical operations on NVIDIA GPUs. CuPy is widely used in fields like deep learning, scientific computing, and data analysis, where large-scale computations require efficient processing. CuPy leverages CUDA (Compute Unified Device Architecture)…

-

Theano: Python Library for Efficient Numerical Computation

1. Introduction Theano is an open-source Python library for numerical computation, particularly designed for deep learning and scientific computing. It allows users to define, optimize, and evaluate mathematical expressions involving multi-dimensional arrays efficiently. Theano is widely used in academia and industry for tasks such as neural network training, symbolic differentiation, and GPU-accelerated computation. Although Theano…

-

TensorFlow Probability: Probabilistic Programming and Statistical Inference Library

1. Introduction TensorFlow Probability (TFP) is an open-source Python library built on TensorFlow, designed for probabilistic programming and statistical inference. It provides tools for defining probability distributions, performing Bayesian inference, and building probabilistic models. TFP is widely used in machine learning, finance, healthcare, and scientific research for tasks that require uncertainty quantification and probabilistic reasoning.…

-

PyMC: Probabilistic Programming Library for Bayesian Inference

1. Introduction PyMC is an open-source Python library for probabilistic programming and Bayesian statistical modeling. It allows users to define complex probabilistic models using intuitive syntax and perform inference using advanced sampling algorithms like Markov Chain Monte Carlo (MCMC) and Variational Inference (VI). PyMC is widely used in fields such as machine learning, epidemiology, finance,…

-

Statsmodels: Statistical Modeling and Econometrics Library for Python

1. Introduction Statsmodels is an open-source Python library for statistical modeling, hypothesis testing, and econometric analysis. It provides tools for estimating statistical models, performing tests, and exploring data. Statsmodels is widely used in academia and industry for tasks such as time series analysis, regression modeling, and statistical inference. Unlike machine learning libraries like Scikit-learn, Statsmodels…

-

Scikit-learn: Machine Learning Library for Python

1. Introduction Scikit-learn is an open-source Python library for machine learning. It provides simple and efficient tools for data mining, data analysis, and predictive modeling. Built on top of NumPy, SciPy, and Matplotlib, Scikit-learn is widely used in academia and industry for tasks such as classification, regression, clustering, and dimensionality reduction. Scikit-learn is known for…

-

SymPy: Python Library for Symbolic Mathematics

1. Introduction SymPy is an open-source Python library for symbolic mathematics. It provides tools for performing algebraic operations, calculus, equation solving, and more, all in a symbolic form. SymPy is widely used in scientific research, engineering, education, and computational mathematics, offering a powerful alternative to numerical computation libraries like NumPy. SymPy is designed to be…

-

NetworkX: Advanced Library for Graph Analysis and Network Science

1. Introduction NetworkX is an open-source Python library designed for the creation, manipulation, and analysis of complex networks and graphs. It provides tools for studying the structure and dynamics of networks, making it a powerful resource for researchers, data scientists, and engineers working in fields like social network analysis, biology, transportation systems, and computer science.…

Recent Posts

- Accelerating Image Convolution with CuPy

- Estimating π with a Monte Carlo Simulation Using CuPy

- N-Body Simulation with CuPy: A GPU-Accelerated Approach

- Building a 2D Heat Equation Simulation with CuPy: A Step-by-Step Guide

- Dash: Python Framework for Building Interactive Web Applications for Data Visualization

Tags

Ai's Ai tools AlphaFold API Applications Artificial intelligence Building Clouds Frameworks Generative github High-Performance Infrastructures LangChain Large Language Models lib Library Models Open-sources Prediction project Protein structure python simulation transformers

Comments

CuPy brings serious GPU power to Python—numpy on steroids! ⚡🐍💥

JAX MD is pushing molecular simulations into the future with AI precision! 🧬⚙️🤖